Revisiting Deconstructed PACS

400 million. That's the number of radiology studies (currents and priors) that have been processed and used for primary interpretation by U.S. imaging organizations operating within a Deconstructed PACS strategy over the last four years. Indeed, the modularization of PACS has come a long way, delivering on "best of need" for healthcare organizations from coast to coast.

We've analyzed the transformation, highlighting the current state with fresh perspective in two new articles. Thank you to AuntMinnie.com for publishing Revisiting Deconstructed PACS: Part 1 and Revisiting Deconstructed PACS: Part 2 over the last two days.

What's your imaging journey? If you are considering or have executed a modular PACS strategy, we'd love to hear from you. Please be sure to post your feedback on the AuntMinnie.com Forums, your favorite social media channel, or drop us a note.

[Note: If you missed the original 2014 article on AuntMinnie.com, here's the link to: The Time is Now for Deconstructed PACS.]

Revisiting Deconstructed PACS: Part 1

[Note: The original article published February 27, 2018, may be viewed on AuntMinnie.com here]

February 27, 2018 -- 400 million. That's how many radiology studies (currents and priors) I can confirm have been processed and used for primary interpretation by U.S. imaging organizations operating within a deconstructed PACS strategy since April 2014, when "The time is now for deconstructed PACS" was published on AuntMinnie.com. While 400 million studies is a large number, it represents a mere fraction of the total number of studies, as I personally don't have visibility to all organizations using a deconstructed PACS strategy.

Back in 2014, use of the term deconstructed PACS was new, but today a quick search on Google returns more than 2,000 results. Fundamentally, the term has generated tremendous interest among supporters and detractors, as well as others who have argued that the idea behind deconstructed PACS isn't anything new.

Critics might say that a deconstructed PACS strategy is simply a best-of-breed, modular, or component-based approach to PACS that was once a go-to strategy in the early days of digital image management. All true. However, giving the strategy a catchy name got the industry talking and generated a level of excitement and optimism that hadn't been experienced in PACS for much of the prior decade.

Many of the largest imaging organizations in the U.S. have moved to or are planning a deconstructed PACS strategy, as many enterprises are running under legacy PACS networks that have aged to an average of 10 to 20 years. Those institutions that have not made a strategy decision have multiple alternatives to choose from, ranging from single to modular approaches; however, they are aware of the reality that their decision will need to future-proof their organization for the next decade and beyond.

The state of modular PACS solutions

Why have institutions chosen to implement modular PACS solutions? Because they were tired of underperforming software that failed to meet expectations, restricted advancement, and failed to keep up with changing enterprise demands in patient care at healthcare enterprises.

For example, the growing adoption of vendor-neutral archives (VNAs) is undeniable, and for many institutions this represents a move toward deconstruction. Over the past few years, the generally accepted basis for VNA has evolved, as many of the first movers have been acquired, a few vendors self-developed VNAs, and still other PACS archives were rebranded as VNAs.

Other institutions with challenges not sufficiently served by RIS- or PACS-driven workflow sought to deconstruct first with workflow engines. Some of these workflow engines were self-developed, others have been spun off into successful commercial products, and still others have been acquired by large vendors.

Workflow has also leapfrogged RIS-driven and PACS-driven approaches to ones driven by electronic health records (EHRs). Many integrated delivery networks (IDNs) have leadership mandates to maximize the value of their massive EHR investments and have embarked on EHR-driven workflow (for radiology, cardiology, and other specialties).

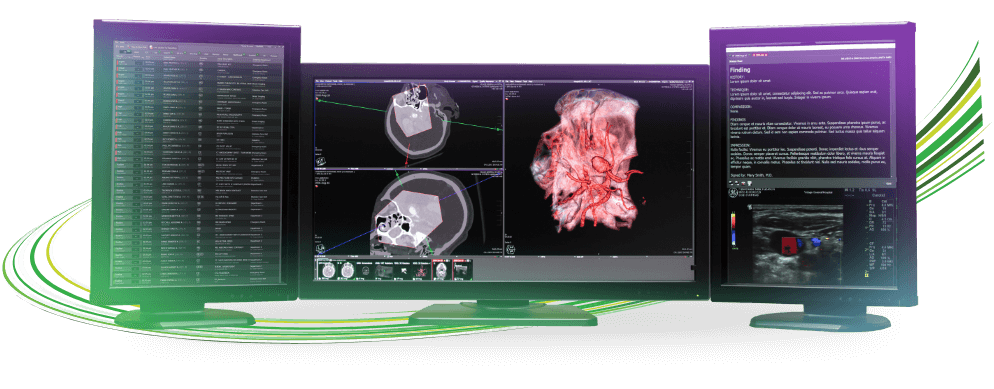

Still others have chosen to move forward with an enterprise viewing platform that could eliminate one or multiple viewers (e.g., diagnostic, clinical, breast imaging, 3D/advanced, specialty, mobile, or EHR) that have been poorly served by legacy PACS, delivering images faster and with more clinical capability and greater accuracy. Some organizations have chosen to move forward with one or more modular solutions, depending on organizational priorities and/or prior informatics investments.

'Best of need'

The total number of institutions invested in modular components is quite sizable. The reality is that imaging is sophisticated and can be quite complicated, and while many organizations share similar missions, each institution executes a local strategy. Instead of "best of breed," one could argue it's really "best of need."

There is no single approach for a deconstructed PACS strategy. Is a deconstructed PACS strategy the combination of a VNA + Workflow Solution + Enterprise Diagnostic Viewing Platform? Yes. Absolutely, it could be.

How about an EHR-driven Workflow + VNA + Enterprise Diagnostic Viewing Platform? Yes, indeed. What about Legacy PACS + VNA? You can make an argument that this, too, is a deconstructed PACS strategy.

Informed decision-making

The power of deconstruction lies in institutional empowerment, flexibility, and the results of tangible patient care improvements. The decision is not about the vendors involved in the final equation, it's the integrated solutions that together comprise the institution's path to enterprise imaging. The best approach comes from informed decisions based on proven systems that have been designed to work in an interoperable, multivendor environment.

All institutions are seeking the optimal combination to deliver the best possible interoperability, results, and performance, and the extent of deconstruction is up to the institution. Can all the components of a deconstructed PACS be supplied by one or multiple vendors? Absolutely, if the offered solutions are modular, truly open, and don't contribute to lock-in.

However, if the vendor(s) you are working with do not have a history of openness and have not proved their capabilities through a real-world proof of concept, it's reasonable to remain skeptical of their claims.

Real-world examples

Why is a modular strategy smart for today and the future of imaging? Here are real-world examples where modularization can help.

Innovation, not commoditization. Innovation comes in many flavors and doesn't wait. Many legacy PACS vendors stopped innovating, which accelerated PACS commoditization. PACS promoted as a single platform or an all-in-one solution -- without demonstrated support from the vendor to allow open, interoperable solutions -- may lock the institution into a long-term relationship that's difficult to unwind when the circumstances require change.

It's hard not to reflect on the past performance of many of these systems. For example, introducing add-on viewers to legacy platforms is not innovation. While on the surface it may appear that new viewers are progressive, these viewers add to support and operational complexity, and they mask the state of the underlying system architecture that continues to age.

For example, some legacy PACS diagnostic workstations do not have the necessary interoperability with VNAs and are unable to display prior imaging. In those circumstances, they require the use of adjunct clinical viewers to access prior imaging studies from the VNA. Is that innovation?

Keep your eye on the ball. I've met with many health systems that thought they were making the right choice by standardizing on a single vendor for PACS across their multilocation hospital systems. In many cases, this did not lead to the expected benefits of cross-location image sharing, remote reading, interoperability, performance gains, or institutional leverage to positively influence innovation. For example, if remote reading was a key attribute for improving radiologist productivity, as well as radiologist quality of life, the institution must ensure this is fully tested prior to selection.

The promise of next-generation gone bad. Generational leaps in technology often demo better than they work in production, and they may take years to mature into reliable solutions. When a vendor's legacy PACS is no longer an option due to significant performance and capability gaps, but its next-generation PACS is also not ready, institutional options quickly evaporate and a quagmire results. A modular strategy could offer more options, enabling the institutions to release themselves from imaging informatics purgatory.

The modular path

The schedule is blown, and the workflow/performance gaps are adding up. You've done your homework, you've made your selection(s), and you're deep in the implementation. Whether you've chosen one vendor for everything or multiple vendors, there's always a risk that the schedule and capabilities can't be met.

I know of multiple institutions that have gone both ways, and years after the request for proposal, they are still not fully live or, in some cases, not live at all. It's appalling how many recent installations I have come across that have outright failed, have been forced to roll back, or have been postponed or delayed with significant uncertainty for next steps.

Has your vendor oversold its capabilities, is your migration more challenging than anticipated, or is one of the components weaker than required? If your institution purchased an all-in-one solution, you may be stuck for the long haul with chronic buyer's remorse.

But if you chose a modular path, you may be able to quickly exit the poor-performing solution for a better option that allows you to stay on course to deliver the results and performance required.

Revisiting Deconstructed PACS: Part 2

[Note: The original article published February 28, 2018, may be viewed on AuntMinnie.com here]

February 28, 2018 -- If there's one constant, it's change, and with change comes diversity. Independent vendors exist in all of the major areas of modular PACS solutions, with market forces influencing the growth of the top players and a mix of success and failure for others.

Still other vendors have been acquired as a number of larger companies went on buying sprees, acquiring niche firms specializing in vendor-neutral archives (VNAs), workflow, viewers, analytics, and DICOM plumbing. Some vendors may continue selling multiple modules independently, while others offer them together as single-vendor modular solutions.

There are also several large PACS vendors that are publically for sale, others pondering potential sale, and some that have announced they are seeking "strategic alternatives." A few vendors have developed new technologies that show promise, while others have continued to stagnate technologically but have been aggressive on price to try to remain relevant in a competitive market.

Interoperability

A fundamental component of any informatics solution, interoperability has made great strides of late. Modern diagnostic viewers and VNAs supporting Imaging Object Change Management (IOCM) have ensured that the days of performing manual quality control changes separately on the PACS/diagnostic viewer and on the VNA are numbered. Increasingly, VNAs and viewers are also supporting XDS-I, but how many institutions use it in production? Not many.

Image viewers have dramatically improved accessibility to imaging results from the electronic health record (EHR), but performance and features vary widely. While viewing non-DICOM images and medical multimedia objects is of great interest for enterprise imaging, these orders-based and encounters-based workflows are still years away from being widespread. Also, many healthcare institutions are reluctant to unleash the full value of mobile devices for accessing imaging results, with security concerns hampering the promise of improved patient care.

On a positive note, there have been encouraging developments in web services and HL7's Fast Healthcare Interoperability Resources (FHIR) standard to further enhance application integration. The chasm between informatics solutions has never been closer with the capabilities of modern interoperability.

Future vs. today

In 2018, enterprise imaging has firmly taken hold of product road maps and shaped the industry's imagination. The Enterprise Imaging Workgroup, a collaboration between the Healthcare Information and Management Systems Society (HIMSS) and the Society for Imaging Informatics in Medicine (SIIM), developed seven groundbreaking white papers in 2016 to describe the state of the art.

Whereas once upon a time we were enthralled with the possibilities of big data and the cloud, the current rage is now artificial intelligence (AI) and machine learning. These efforts have spawned dozens of start-ups and academic data science initiatives, all working to develop new algorithms to best tap into the raw computational power of graphics processing units (GPUs).

While there's tremendous excitement (and, for some, trepidation) about the future of these technologies, the reality is most imaging organizations are still struggling with today. Imaging experts have repeatedly vocalized the lack of readiness of today's imaging infrastructure. Existing systems have become burning platforms being used well beyond their intended life cycle, as institutions struggle with massively large current/prior modality datasets.

Many institutions are wondering the following:

- What are our options the next time our PACS goes hard down?

- My PACS database is nearing full capacity. What can I do about it?

- Do I reduce scheduling slots for digital breast tomosynthesis (DBT) so I can get priors sent in time?

- Do we refresh hardware again but keep struggling with the same old architecture?

- How am I going to support the new hospital we're building and the newly acquired system across town?

- Do we partner or merge with the regional outpatient group competition, or consider the commercial buyout offer on the table?

- Should I take the next upgrade, or make a system change to support the future growth that's planned?

- Will a "good-enough" strategy allow us to tread water, or should we choose a long-term strategy of differentiation to allow us to compete and scale?

These questions remain the foremost concerns of most institutions -- not "how am I going to implement this new lung nodule AI algorithm?" Make no mistake, AI is the future, but for most institutions, establishing a solid enterprise imaging foundation is their No. 1 priority.

Replacement initiatives over the past few years have been encouraging. There are impressive success stories of academics, large health systems, and outpatient groups that have transformed their imaging services, some of which were presented at the SIIM and RSNA 2017 conferences.

Many have chosen a modular strategy, whereas a few have chosen traditional routes. These transformers have blazed a path of success for other likeminded imaging organizations to follow.

Best practices will eventually work their way to smaller institutions that are seeking PACS replacement, many of which will choose proven modular systems that have been designed to work in an interoperable, multivendor environment. Or they may adopt cloud-based delivery models (as bandwidth availability to the cloud continues to improve and becomes more affordable), with VNAs and other modular components installed, maintained, and delivered remotely.

While the jury is still out, it's no longer a question of if but when we will see imaging organizations prepared to make the leap to the cloud, which, until now, most have been reluctant to do.

Summary

Far from being merely aspirational, best-of-breed/modular or deconstructed PACS strategies have broken down the barriers of traditional PACS, revolutionizing enterprise imaging. The modularization of imaging informatics solutions has accelerated, from the actions of innovative, independent vendors and the acquisition of independents by traditional vendors, as well as the promoted modularization of traditional all-in-one solutions. The benefit to imaging organizations is that modularization has led to more choice and flexibility, supported by recent strides in interoperability.

In the end, it's not about the vendors involved -- it's about proven solutions working together that comprise an institution's best path forward. Solutions may come from one or multiple vendors, as long as the components are truly modular and interoperable.

It is a healthy practice to ponder what's on the horizon. What is the next disruptive imaging modality? Beyond DBT? 7-tesla MRI? What will happen once the access and display of non-DICOM/medical multimedia objects is widespread? How will AI affect clinical practice?

No one knows for sure, but there is certainty that legacy PACS solutions designed in the last century are ill-equipped for the future of imaging. The history of PACS has proved there will never be a single platform that does everything well today, as well as everything well in the future. This is an unrealistic expectation and misses the mark.

I'm sure today's institutions never imagined they would be using their PACS for 10 to 20 years, when PACS replacements years ago averaged a brisk five years. How's that flip phone still working for you?

Don't fall victim to the mistakes of the past that limited flexibility and restricted your options. If you don't have a solid imaging foundation, there's no better time than now to firm things up, with an infrastructure that has the flexibility to change.

Be strategic with your informatics decisions by choosing proven solutions designed to work in an interoperable, multivendor environment. That way, when a better modular solution becomes available, you can seize the opportunity. You and your patients can't afford to wait 10 to 20 years to benefit from the next big thing!